Improving how we support advisers

At Resolution Life, we are highly focused on, and investing resources to improve how we support advisers in their aims to service our joint customers. We appreciate that our separation work during 2022 resulted in service challenges for you and customers.

Telephone support

Adviser call volumes in February this year were close to 12% down compared to same time last year. This trend has been driven by several factors, including:

- Advisers are increasingly using My Resolution Life portal and online chat as channels to gain information on customers and make service requests. Read more about a recent improvement to the portal, our online premium calculator.

- Admin backlogs, which resulted in an increase in advisers calling for status updates, were cleared during December 2022.

We’re also hiring more service specialists to support this important channel.

Registry management

As we set up our own Adviser Registry System late last year, we uncovered historical customer/adviser alignment issues. There was an increase in adviser requests to move customer books to different adviser IDs/Codes, which caused a backlog in actioning these demands.

We understand this makes things difficult for advisers, eg not seeing customers within My Resolution Life, and this backlog has had operational management focus. An increase in staffing in the Registry Management team has reduced the registry backlog by ~30% since the start of January. Furthermore, we are aiming to drive down ‘to be actioned’ requests through improving our ‘bulk customer transfer’ functionality. We expect this new functionality to be operational late March.

Future improvements

We understand that not all calls are the same regarding complexity, with this especially so for advisers. Some calls can be handled quickly, while others are multi-faceted. We will provide further updates soon, as we introduce changes to call center structure and processes to cater for this difference in call types.

Tips for searching customer documents in My Resolution Life

If you were using Intermedia to access customer documents and now need to use My Resolution Life, this article steps you through the process.

From late February, you can now access customer correspondence and documents from the past 20 years for the following products on My Resolution Life:

- LifeTrack

- Investment Linked and Portfolio Plans

- Replacement Income Insurance Policy

How to access customer documents on My Resolution Life

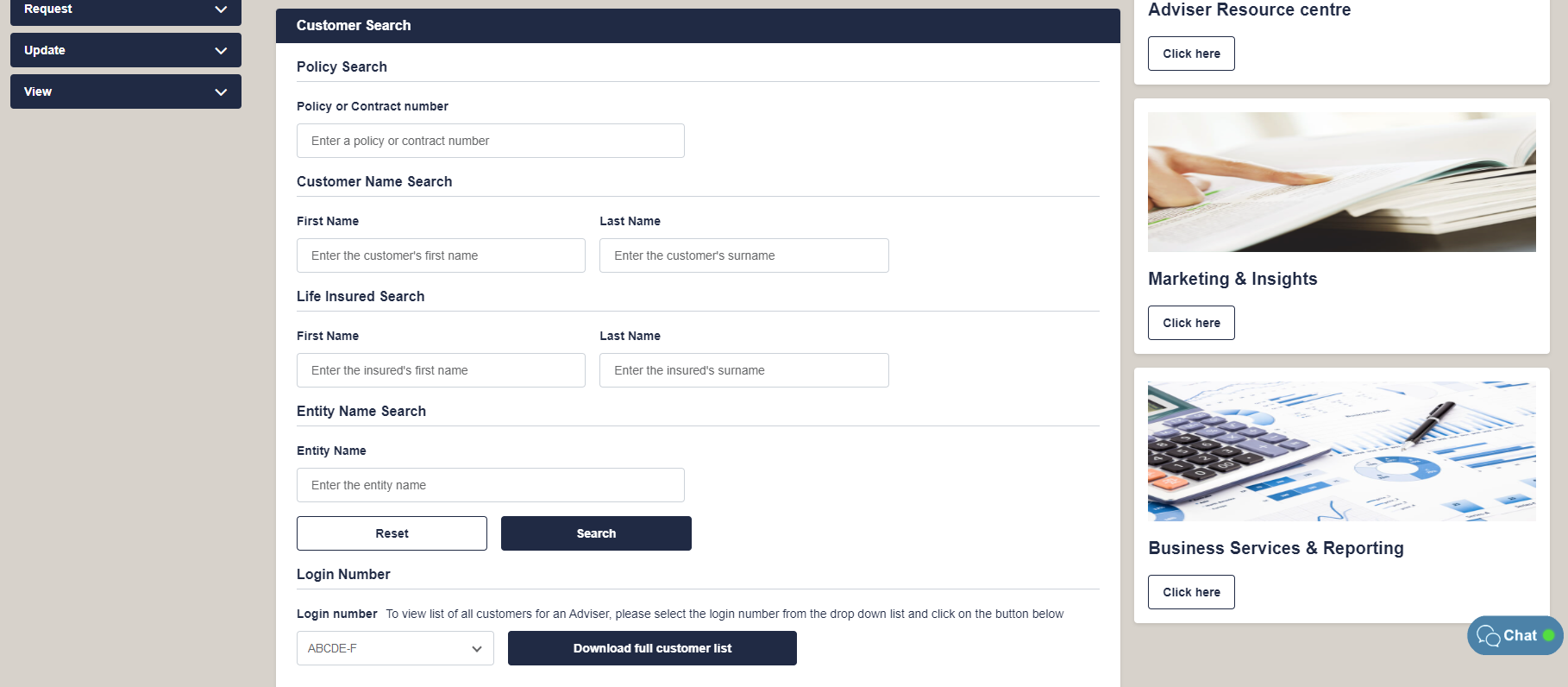

1. Log in to My Resolution Life. On login, use the Customer Search function from the home dashboard.

2. Search for a customer using the available search options.

When searching for your customers, please note the following:

- When searching by customer name, please include both first name and surname.

- When searching by policy number, please type in the policy number in full. This includes any special characters, such as hyphens.

- You can find out the full format of your customer’s policy number (including any special characters) from your customer list. Get your full customer list by selecting Download full customer list, as per the above screenshot.

- Our how-to-guide also includes more information on how to search for your customers.

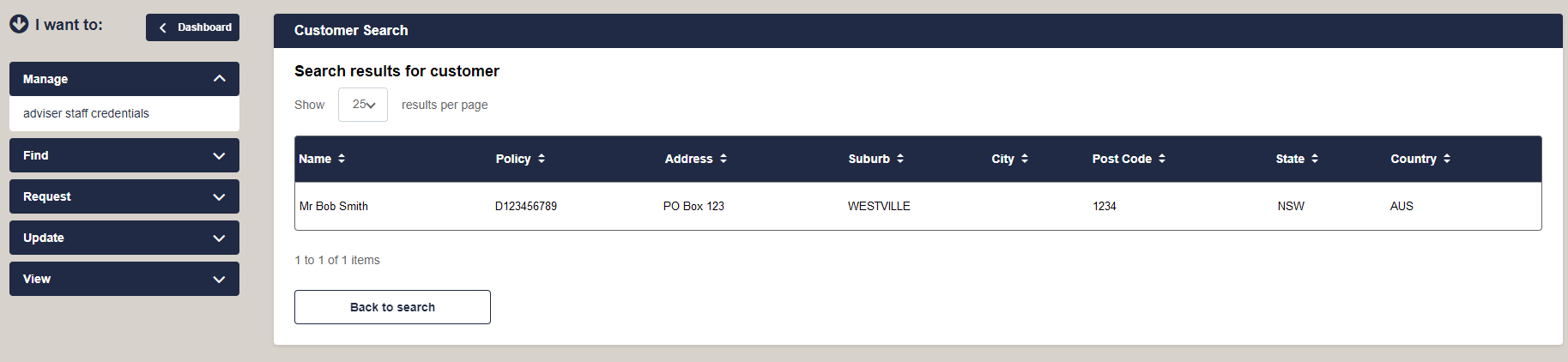

3. From the displayed list of search results, simply click on the relevant customer record.

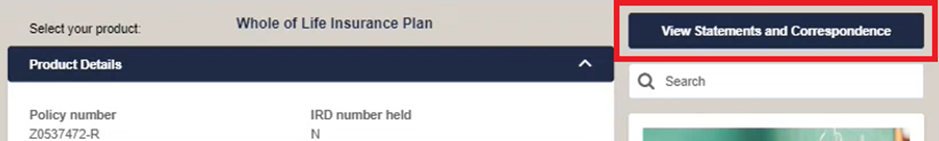

4. This will take you to Customer view. On Customer view, select View Statements and Correspondence.

5. This will take you to the customer’s statements and correspondence. Simply select View to open a document. The document will open in a new window as a PDF file.

Missed payments reports and renewal notices

In switching from Intermedia to My Resolution Life, certain customer reports were only available at request. Our key priority has been working on a solution to ensure you can view all the documents previously available instantly on Intermedia. Missed payments and renewal notices will be available on My Resolution Life soon. We’ll be in touch shortly with instructions on how to access these reports.

In the meantime, if you need copies of missed payments reports or renewal notices, please email us at askus@resolutionlife.co.nz.

EasyQuote update required – new version available

We have recently made changes to customer forms available on EasyQuote. These forms have been updated with the current Financial Strength Rating and are available in a new version of EasyQuote.

What you need to do

We request that you complete a manual update of EasyQuote, to ensure the correct forms are being provided to customers.

List of forms updated, available on new version of EasyQuote:

- 6_229344_RL Application and Personal Statement Form_INT.pdf

- 4_229345_RL Short Form Application_INT_C.pdf

- 231773_RL RPP Trauma Disablement Upgrade Form_INT_C.pdf

- 231770_RL Lifetrack or RPP Policy Transfer Application_INT_C.pdf

- 231769_RL Workplace Protection Personal Statement_INT_C.pdf

- 232085_RL Lifetrack Abridged Personal Statement Form_INT_C.pdf

- 231771_RL Application for policy conversion_INT_C.pdf

- 231768_RL Home Loan Cover Application Form_INT_C.pdf

- 231767_RL Life2go application form_INT_C.pdf

- 2_231766_RL Pursuits Questionnaire_INT_C.pdf

- 231772_RL RPP Lifetrack Upgrade Form_INT_C.pdf

- 231765_RL Quick Start Life Application Form_INT_C.pdf

Surrender values to increase for conventional product customers

We’re making a positive change to withdrawal values for our Whole of life and endowment customers across New Zealand and Australia.

A review of our portfolio make-up, past earnings, and statutory fund performance has allowed us to make an out-of-cycle increase in the surrender values. The change will be rolled out by the end of April 2023.

All customers will receive notification of the change in their next annual statement/certificate and will be pointed to our website for more details including FAQs.

The surrender value is the part of the policy that is changing. The surrender benefit is the amount available if a customer chooses to surrender their policy early, before it reaches the agreed end date. Please note, this is a different amount to the actual final maturity or death benefit which has a higher value.

Key points

- There is no call to action for customers as the notification is FYI only.

- A surrender value is less than their maturity/death benefit (where the customer has stayed until the agreed term).

- Customers can see their surrender value by logging into My Resolution Life portal. Note new values will not show until the end of April 2023 and we will provide further updates in this newsletter once the change is complete.

- We always aim to ensure features like annual and terminal bonus rates and withdrawal benefits, distribute benefits equitably to policyholders over the lifetime of their policies.

At any time, withdrawal benefits and other details are available via the My Resolution Life portal.

If you’re interested in receiving a list of your clients and their new withdrawal benefit examples, these can be requested via conventionalwdv_nz@resolutionlife.co.nz

March 2023 customer campaigns

What are we communicating to customers this month?

Inviting your customers to register for My Resolution Life

From late February to late March, we’re inviting customers to register for My Resolution Life by email.

Who’s receiving an email?

All customers who:

- Haven’t yet registered for the portal, and

- Have a valid email on file with us and have not unsubscribed.

Your customers can now register online

If your customers haven’t registered yet, please feel free to remind them about My Resolution Life. With My Resolution Life, customers can complete common tasks online, such as downloading their annual statements, and updating their contact details and correspondence preferences.

To get started, all your customers need is:

- A copy of their annual statement on hand so they can answer a security question, and

- To visit our website.

Life Matters March 2023 edition

Life Matters is our quarterly newsletter full of tips and insights customers. Customers will receive an email this month with the following articles:

- March 2023 economic update

- Who is Resolution Life Australasia?

- Your life insurance and travelling

- Things to consider when reviewing your insurance

- International women’s day

The articles will be available on our public website.

Who’s receiving an email

All customers who have a valid email on file with us and have not unsubscribed.

Important Information

Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life). The content on this website is for information only. The information is of a general nature and does not constitute financial advice or other professional advice. Before taking any action, you should always seek financial advice or other professional advice relevant to your personal circumstances. While care has been taken to supply information on this website that is accurate, no entity or person gives any warranty of reliability or accuracy, or accepts any responsibility arising in any way including from any error or omission.

A disclosure statement is available from your Adviser, on request and free of charge.